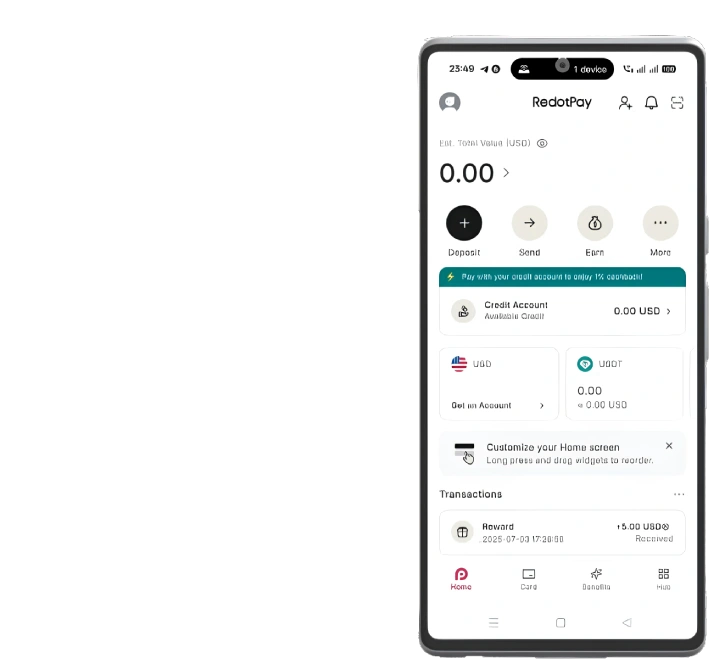

بطاقة ريدوت باي

تحويل الأصول الرقمية

في الإنفاق اليومي

إنفاقك اليومي حوّل عملاتك المشفرة إلى مشتريات يومية اشحن. انقر. انطلق

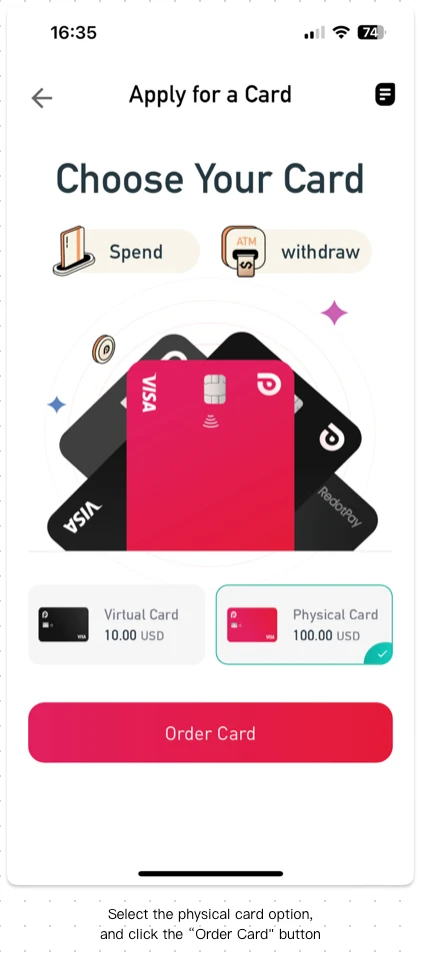

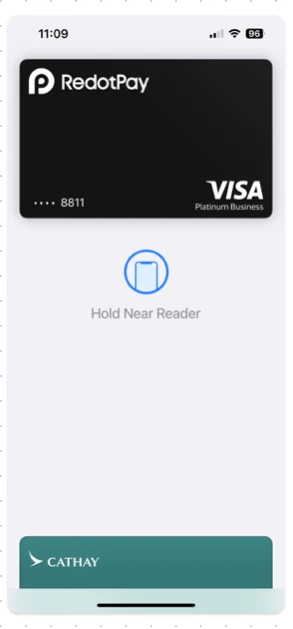

بطاقة افتراضية

ابدأ بسرعة؛ مثالي للاشتراكات وحجوزات السفر والأسواق عبر الإنترنت.

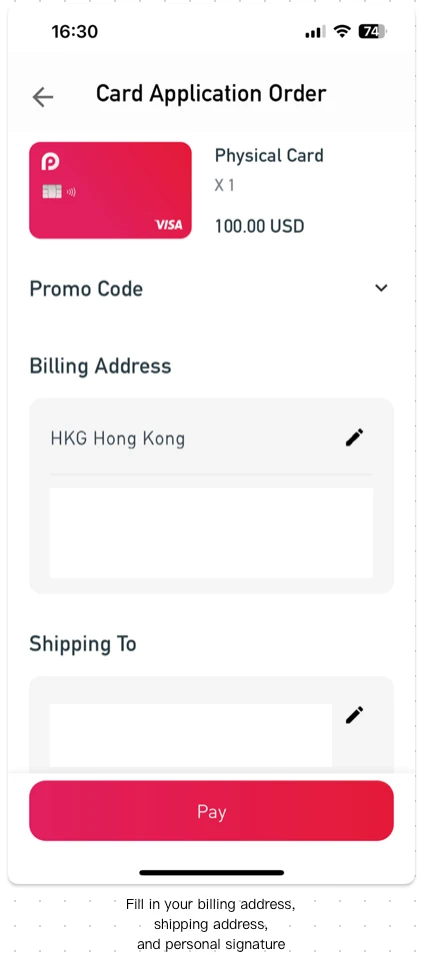

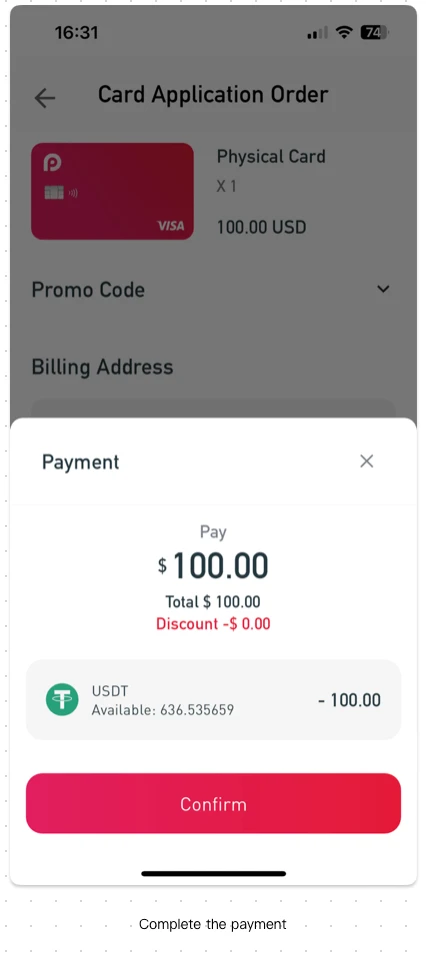

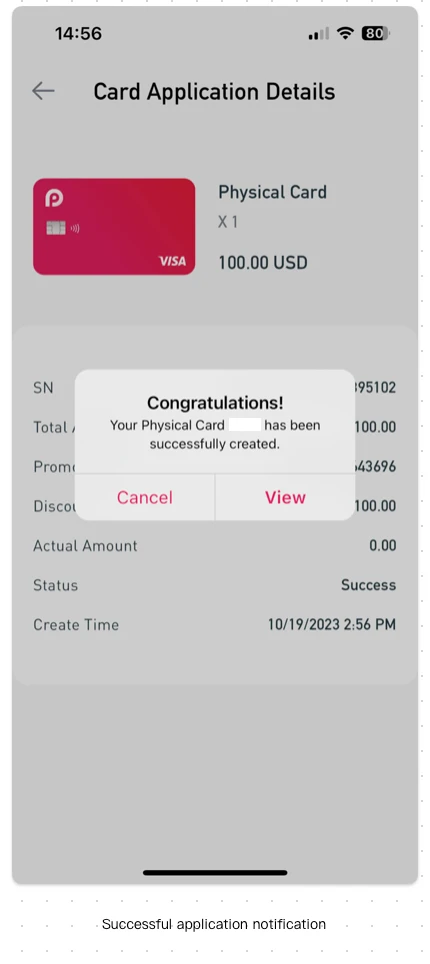

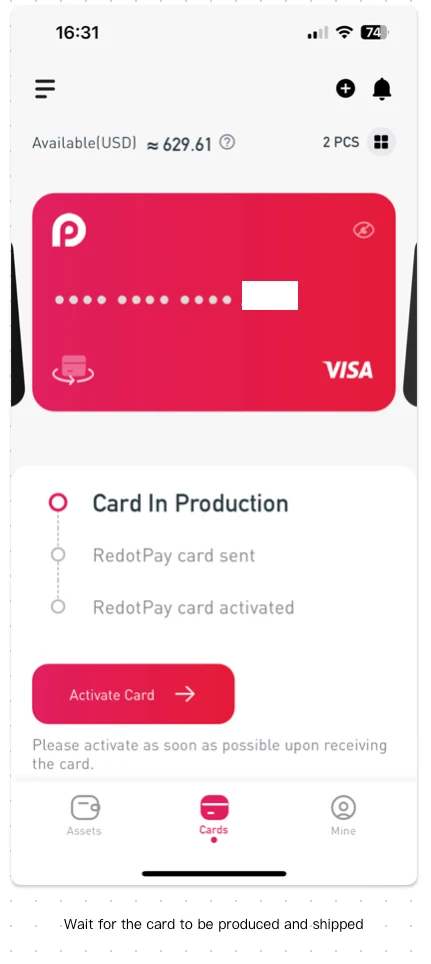

بطاقة مادية

لعمليات الشراء داخل المتجر وسحب النقود من أجهزة الصراف الآلي المدعومة ببطاقة Visa.

المحافظ الإلكترونية

دفع أسرع؛ مفيد في المحطات التي تفضل الدفع بدون تلامس.

الوعي بالتكلفة

يرى رسوم إعادة الشحن بوضوح — رسوم ثابتة أو % معروض قبل أن تؤكد

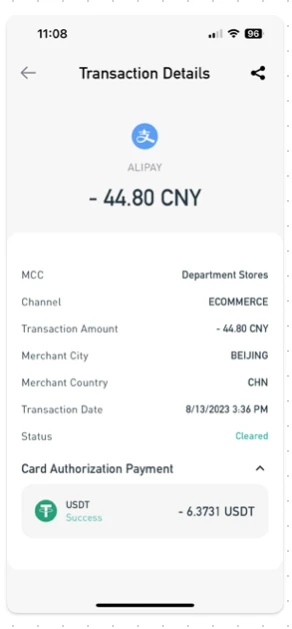

شفاف العملات الأجنبية والتحويل مع اقتباسات حية معروض عند الخروج

تحسين التكلفة الإجمالية - معاملات الدفعة لقطع رسوم متكررة على الفور

بطاقة RedotPay السيناريوهات الشائعة في أي وقت وفي أي مكان

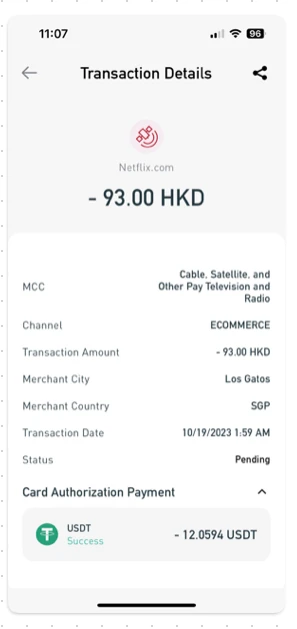

- الاشتراكات عبر الإنترنت: استخدم بطاقة افتراضية؛ قم بتعيين تنبيهات الإنفاق لالتقاط عمليات التجديد.

- نقطة بيع السفر: تأكد من أن المحطة تقوم بالشحن بالعملة المحلية إذا طُلب منك ذلك؛ احتفظ برصيد احتياطي.

- الاسترداد: يعتمد توقيت الاسترداد على التاجر والمخطط؛ لذا احتفظ بالإيصال ورقم البطاقة في متناول يدك.

من متصل إلى غير متصل

بسلاسة

قم بالتسوق عبر مواقع الويب، وانقر عند إتمام عملية الشراء، واشترك في الخدمات، واحصل على إمكانية الوصول إلى النقود في أجهزة الصراف الآلي المدعومة.

🌍 التجار في جميع أنحاء العالم

⚡ سرعة المعاملات

🔒 وقت تشغيل الأمان

👥 المستخدمون والمتزايدون

دائما آمن

جاهز دائما

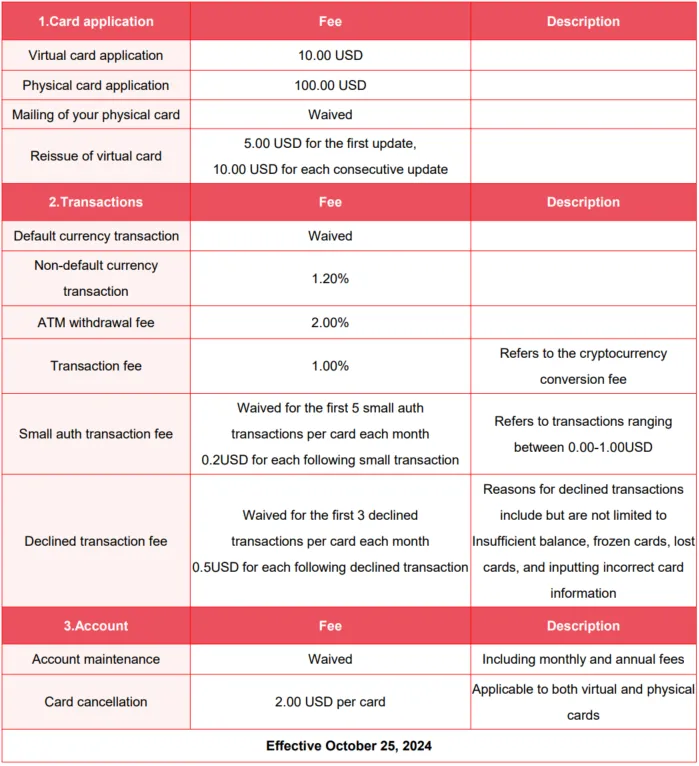

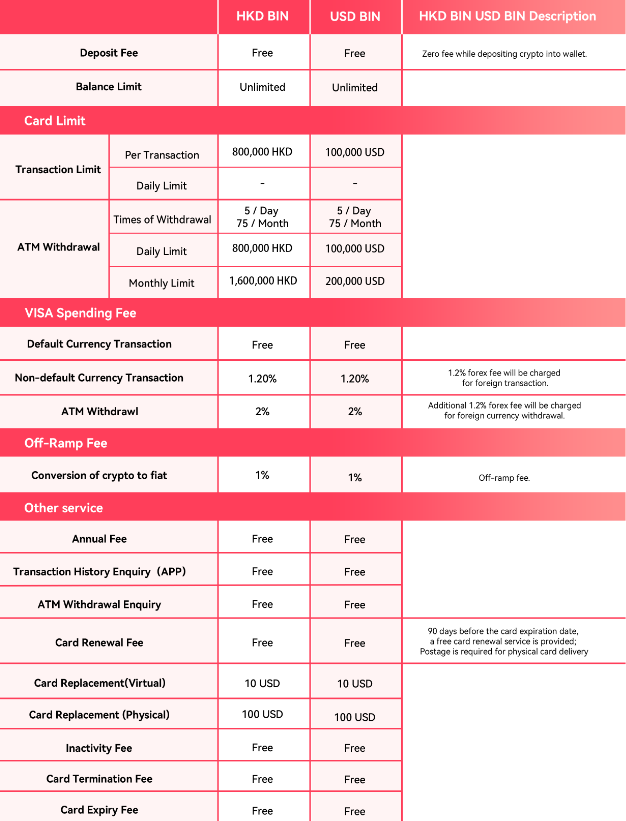

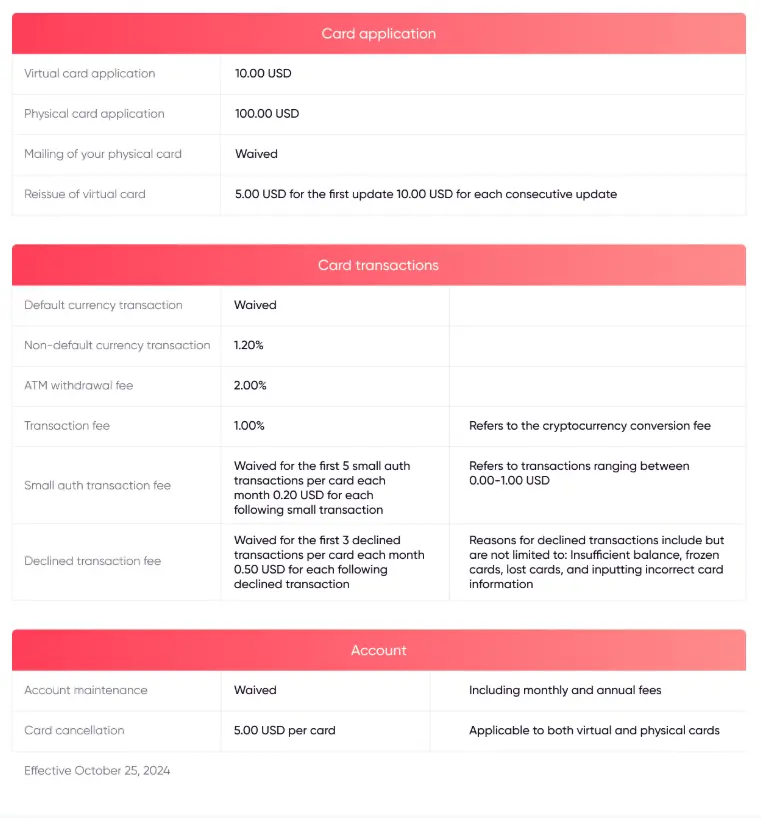

هل هناك رسوم سنوية؟

تتنازل العديد من برامج البطاقات عن الرسوم السنوية؛ ولكن قد يتم تطبيق رسوم أخرى (مثل رسوم الصرف الأجنبي وأجهزة الصراف الآلي وما إلى ذلك).

ما مدى السرعة التي يمكنني البدء بها؟

تتوفر البطاقات الافتراضية عادةً بعد التحقق؛ ويختلف تسليم البطاقة المادية.

أين يمكن استخدام بطاقة RedotPay؟

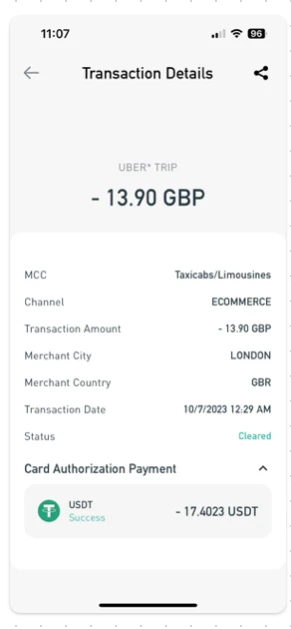

عادةً ما تُقبل بطاقات الائتمان الرئيسية في أي مكان، سواءً عبر الإنترنت أو في المتاجر. قد يختلف القبول الفعلي باختلاف نوع البطاقة. عنوان/منطقة الفاتورة، تاجر الفئة (MCC)، وقواعد التاجر الخاصة.

هل هناك أي استثناءات معروفة؟

بناءً على تقارير المستخدمين، قد تقوم بعض الخدمات برفض أو حظر عمليات إعادة الشحن/الاشتراكات، بما في ذلك ChatGPT / OpenAI, سبوتيفاي، و حكيمقد تتغير السياسات - يرجى تجربة الدفع التجريبي الصغير أولاً.

كيف أستخدم بطاقة RedotPay الخاصة بي لإجراء المعاملات؟

- عبر الإنترنت: أدخل رقم بطاقتك وتاريخ انتهاء الصلاحية ورمز CVV وعنوان الفاتورة عند الدفع، ثم أكمل أي خطوات 3-D Secure/OTP.

- المحافظ والمنصات: عند توفر الدعم، قم بربط بطاقة RedotPay الخاصة بك بمحافظ أو منصات دفع تابعة لجهات خارجية (على سبيل المثال، PayPal) للدفع عبر الإنترنت أو في المتجر.

- في المتجر: استخدم بطاقتك المادية للنقر/الإدخال/التمرير في المحطات التي تقبل شبكة بطاقتك.