Preguntas frecuentes

Esperamos que encuentres lo que buscas. Explora las preguntas frecuentes.

Empezando

Financiamiento, saldos y comisiones

Tarjeta (virtual y física)

Monedero multidivisa

Swap (Conversión entre activos)

Pago global (desembolsos)

Gane (recompensas por activos depositados)

Crédito (respaldado por criptomonedas)

Mercado P2P

Cumplimiento, seguridad y privacidad

Solución de problemas

Editorial y afiliados

- ¿Qué es RedotPay?

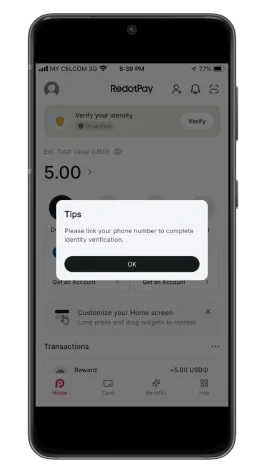

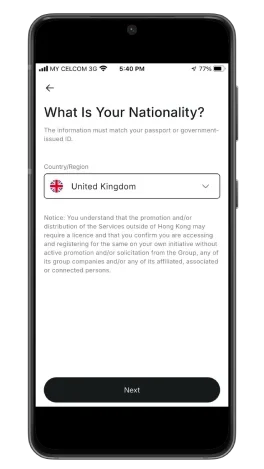

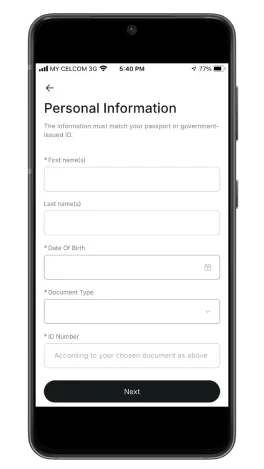

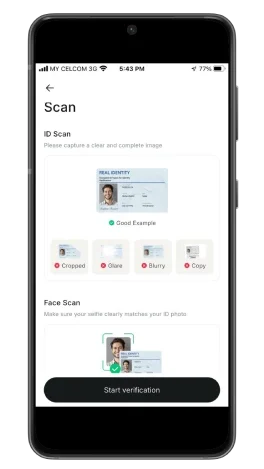

Una aplicación de dinero digital que le permite financiar saldos (incluso con criptomonedas donde sea compatible) y usar funciones como Tarjeta, Billetera multidivisa, Intercambio, Pago global, Ganancias, Mercado P2P y Crédito (la disponibilidad varía según la región). - ¿Necesito verificación (KYC/KYB)?

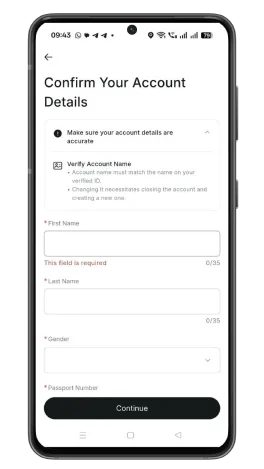

Sí. Los usuarios particulares completan el proceso KYC; las empresas, el KYB. Los niveles de verificación más altos suelen desbloquear límites más altos y más funciones. - ¿Qué países son compatibles?

La cobertura varía según el producto y la región. Verás la disponibilidad en la app durante el proceso de incorporación. - ¿Cuánto tiempo lleva la incorporación?

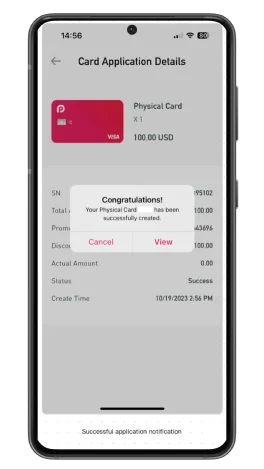

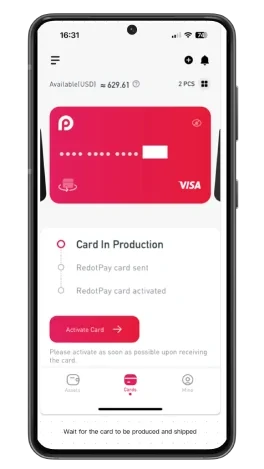

La mayoría de los usuarios pueden completar el registro y crear una tarjeta virtual poco después de la verificación. Los plazos de entrega de las tarjetas físicas varían según la región. - ¿Puedo usar la aplicación sin tener criptomonedas?

Sí. Algunas funciones también admiten financiación en moneda local (cuando esté disponible).

- ¿Cómo agrego fondos?

Utilice rieles compatibles en su región (por ejemplo, depósitos en cadena, recargas de billeteras/intercambios de terceros o transferencias bancarias). - ¿Qué tarifas debo esperar?

Elementos comunes: comisiones por depósito/recarga, cambio de divisas/liquidación de transacciones en moneda extranjera y comisiones de cajeros automáticos/operadores. Siempre revise la cotización en la app antes de confirmar. - ¿Qué moneda debo mantener para los gastos diarios?

Mantén la moneda en la que gastas con más frecuencia para minimizar las conversiones. Reserva un pequeño margen para la variación cambiaria y las preautorizaciones. - ¿Puedo retirar dinero a mi banco?

En corredores admitidos, sí. Los tiempos de procesamiento dependen del horario del ferrocarril y de los bancos locales. - ¿Cobran una tarifa anual por la tarjeta?

Los programas de tarjetas generalmente no aplican cuotas anuales, pero pueden aplicar otros costos (cambio de divisas, cajero automático, recargas). Consulta la página de cuotas de la aplicación.

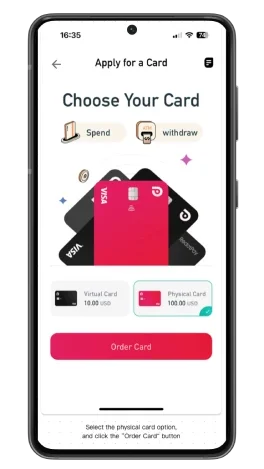

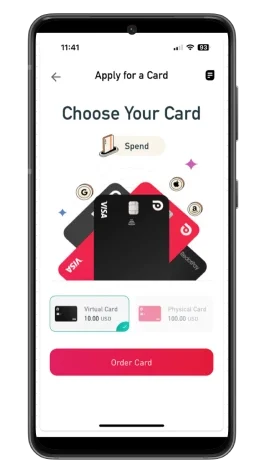

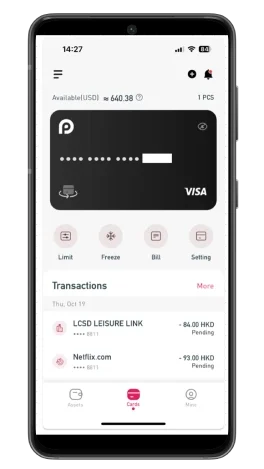

- ¿Cuál es la diferencia entre tarjetas virtuales y físicas?

Virtual: configuración rápida para uso en línea. Física: pagos en tiendas y acceso a cajeros automáticos (donde sea compatible). Muchos usuarios mantienen ambos. - ¿Dónde puedo utilizar la tarjeta?

En cualquier lugar donde se acepte la red. Algunas categorías de comercios o regiones pueden estar restringidas. - ¿Puedo agregar la tarjeta a Apple/Google Pay?

Sí, en las regiones compatibles. Encontrarás opciones de billetera dentro de la app. - ¿Cómo puedo evitar el rechazo de mi tarjeta?

Mantenga un saldo de reserva, confirme la compatibilidad con la región/categoría, asegúrese de que la tarjeta no esté bloqueada e ingrese los datos correctamente. En el punto de venta, pruebe sin contacto → inserte → billetera móvil. - ¿Consejos para los cajeros automáticos?

Tenga en cuenta las posibles comisiones por retiro y del operador; utilice retiros más grandes y menos frecuentes. Si se ofrece la Conversión Dinámica de Divisas, elija la moneda local.

- ¿Qué es la Billetera Multi-Moneda?

Una vista unificada de sus saldos digitales y en moneda local dentro de una sola aplicación. - ¿Qué tan rápidas son las transferencias entre saldos?

Los movimientos dentro de la aplicación están diseñados para ser rápidos; las condiciones de la red/ferrocarril pueden afectar el tiempo. - ¿Puedo tener varias monedas a la vez?

Sí, en las regiones compatibles. Mantener la moneda de gasto reduce el costo de FX.

- ¿Qué hace Swap?

Convierte un activo en otro dentro de la aplicación para que puedas reequilibrar o financiar una moneda de gasto rápidamente. - ¿Cuándo debería cambiar o pagar directamente?

Cambie primero si las tarifas o los diferenciales de red lo hacen más económico que pagar directamente. De lo contrario, pague directamente para evitar conversiones adicionales. - ¿Las cotizaciones son fijas?

Verá una cotización en vivo antes de confirmar. El pago final refleja esa cotización más los costos de enrutamiento y red.

- ¿Qué es Global Payout?

Un flujo de trabajo para enviar fondos a destinatarios en corredores compatibles (por ejemplo, banco, tarjeta, billetera), desde un saldo financiado centralmente. - ¿Quién lo utiliza?

Mercados, SaaS/agencias, equipos/DAO: cualquiera que ejecute pagos recurrentes. - ¿Cómo controlo los costos?

Lote por moneda/región, establezca umbrales de pago mínimos y pruebe cada corredor con una pequeña cantidad antes de escalar.

- ¿Están garantizadas las devoluciones?

No. Las recompensas son variables; los indicadores proyectados o de 7 días son solo informativos. El capital está en riesgo. - ¿Hay algún bloqueo?

Earn está diseñado para un acceso flexible; puedes retirar dinero en cualquier momento (pueden aplicarse costos de red/transacción). - ¿Puedo seguir ganando y aún así gastar?

Sí, mantenga un pequeño margen de gasto para evitar retiros forzados.

- ¿Cómo funciona el Crédito?

Pledge apoyó las criptomonedas como garantía para desbloquear una línea de crédito. Gasta o transfiere desde esa línea; reembolsa para recuperar el margen. - ¿Cuales son los riesgos?

Si el valor de la garantía disminuye, podría necesitar añadirla o reembolsarla. Es posible que se produzca una liquidación. Mantenga las alertas activadas y un colchón de reservas. - ¿Las tarifas y los límites son los mismos para todos?

No. El LTV, los límites, los corredores y los precios varían según la región y el nivel de verificación.

- ¿Qué es el Mercado P2P?

Compra/venta entre pares (a menudo, monedas estables) mediante métodos de pago locales, protegidos por depósito en garantía. - ¿Existen tarifas de plataforma?

Las promociones varían. Tu banco o billetera electrónica podría cobrarte. Consulta siempre la cotización en tiempo real. - ¿Consejos de seguridad para las transacciones P2P?

Opere con usuarios verificados y de alta calificación, mantenga todas las pruebas en la plataforma, siga los términos del anuncio y utilice disputas dentro de la aplicación; nunca resuelva fuera de la plataforma.

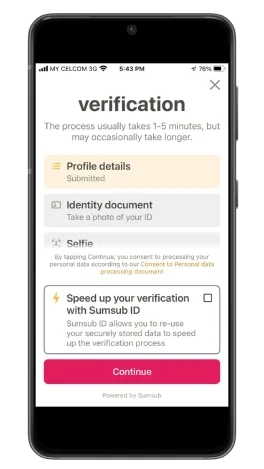

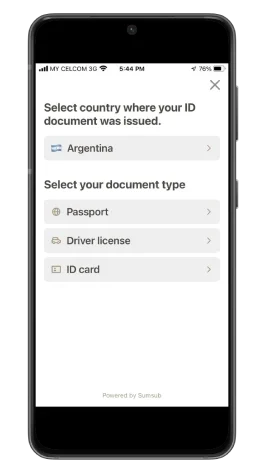

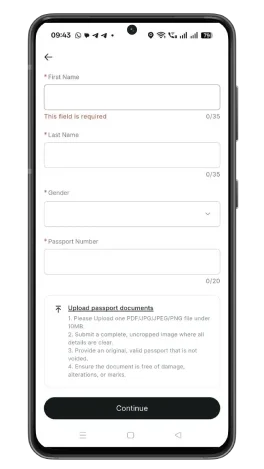

- ¿Por qué necesito KYC/KYB?

Para cumplir con los requisitos reglamentarios, reducir el fraude y desbloquear límites y funciones más altos. - ¿Qué medidas de seguridad existen?

2FA, verificación de dispositivos, control de tarjetas (bloqueo/límites) y monitoreo. También debería proteger su correo electrónico/teléfono y evitar compartir códigos. - ¿Vendes mis datos personales?

Somos un sitio editorial independiente. Consulta nuestra Política de Privacidad para saber cómo utilizamos las herramientas de análisis, atribución de afiliados y correo electrónico; no vendemos información personal.

- Mi tarjeta fue rechazada, ¿qué hago ahora?

Consulta el saldo y el límite de reserva, la compatibilidad con regiones y categorías, el estado de la tarjeta y reinténtalo con la billetera sin contacto, insertando la tarjeta o con la billetera móvil. Si está en línea, verifica la dirección de facturación y las indicaciones de 3-D Secure. - No ha llegado el reembolso.

El plazo de reembolso depende del comercio y la red. Conserve los recibos y revise el historial de transacciones; contacte con el servicio de atención al cliente si se excede el plazo indicado. - Un pago parece retrasado.

Pueden aplicarse horarios de corredores/ferrocarriles o de bancos. Confirme los datos del destinatario y consulte las actualizaciones de estado en el panel de control o la aplicación. - No puedo pasar la verificación.

Asegúrate de que tu identificación sea válida y coincida con tu perfil, usa una foto bien iluminada y vuelve a intentarlo. Si falla repetidamente, contacta con el servicio de asistencia.

- ¿Es usted RedotPay?

No. Somos un sitio independiente. Si te registras a través de nuestros enlaces, podríamos ganar una comisión, sin coste adicional para ti. - ¿Cómo mantener la información actualizada?

Monitoreamos las páginas de productos y los comentarios de los usuarios, y actualizamos nuestras guías y notas de tarifas con las fechas de última actualización. Confirme siempre los detalles en la aplicación antes de realizar una transacción.

Elige tu mejor opción

Explora nuestros planes de precios

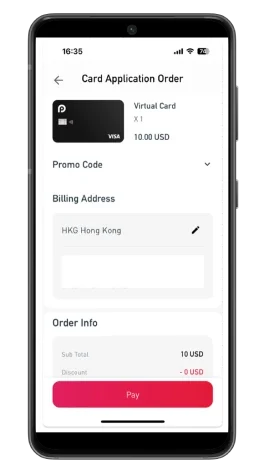

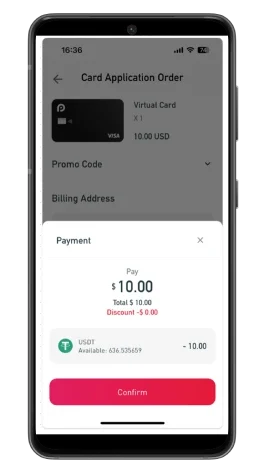

1Tarjeta Visa

$20

Tarjeta virtual

- No se permite el envío de correos

- Reemplazo: 5,00 USD (primera actualización), 10,00 USD cada actualización posterior

- Compras online, suscripciones, reservas de viajes

- Apple Pay y Google Pay: compatibles donde estén disponibles

- Emisión virtual instantánea después de la verificación

- Límite por transacción: hasta 100.000 USD

- Límite total diario: hasta 1.000.000 USD

- Límite total mensual: hasta 1.000.000 USD

- Tarifas: transacción en moneda predeterminada exenta; no predeterminada 1,20%; conversión de criptomonedas 1,00%

- Tarifa de autorización pequeña: se eximen las primeras 5 por tarjeta/mes, luego 0,20 USD cada una (≤ 1,00 USD)

- Tarifa rechazada: se eximen las primeras 3 por tarjeta/mes, luego 0,50 USD cada una

- Mantenimiento de cuenta: exento • Cancelación de tarjeta: 2,00 USD

- Inactividad: las tarjetas no utilizadas se cierran después de 6 meses

En línea y suscripciones, crear en minutos, sin envío de correos, Es más barato empezar usar con billeteras móviles

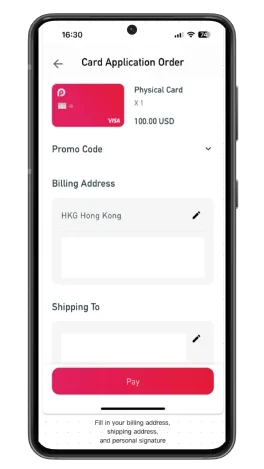

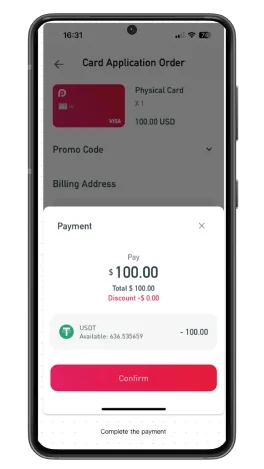

2Tarjeta Visa

$100

Tarjeta física

- Envío exento

- Pagos en tiendas con deslizar, tocar y chip. Retiros en cajeros automáticos (tarifa de 2.00% + cualquier tarifa del operador; se aplican límites).

- Apple Pay y Google Pay: compatibles donde estén disponibles

- Compras y suscripciones online globales

- Límite por transacción: hasta 100.000 USD

- Límite total diario: hasta 1.000.000 USD

- Límites de conteo de cajeros automáticos: 5/día, 75/mes

- Límite diario en cajeros automáticos: 80.000 HKD (HKB BIN) • 3.750 USD (USD BIN)

- Límite mensual en cajeros automáticos: 1.600.000 HKD (HKB BIN) • 116.250 USD (USD BIN)

- Tarifas: transacción en moneda predeterminada exenta; no predeterminada 1,20%; conversión de criptomonedas 1,00%

- Tarifa de autorización pequeña: se eximen las primeras 5 por tarjeta/mes, luego 0,20 USD cada una (≤ 1,00 USD)

- Tarifa rechazada: se eximen las primeras 3 por tarjeta/mes, luego 0,50 USD cada una

- Mantenimiento de cuenta: exento • Cancelación de tarjeta: 2,00 USD