Crypto Without Borders RedotPay Spotlight

Crypto Without Borders: RedotPay’s Push to Everyday Payments

A recent spotlight piece highlighted how RedotPay is stitching blockchain rails into day-to-day payments. With global crypto ownership estimated in the hundreds of millions, and central banks actively exploring digital currencies, the case for simple, borderless spending continues to strengthen.

Why this matters

- A new payments habit: Younger users—who now make up a large share of crypto consumers—are increasingly comfortable treating digital assets like everyday money.

- Merchant reach: RedotPay positions its card for in-store, online, and ATM use across a vast merchant footprint, aiming to make crypto spending feel as familiar as fiat.

- No manual conversion: The platform emphasizes pay-with-crypto flows without forcing users to pre-convert to cash first, and it supports popular mobile wallets for contactless checkout.

What RedotPay offers today

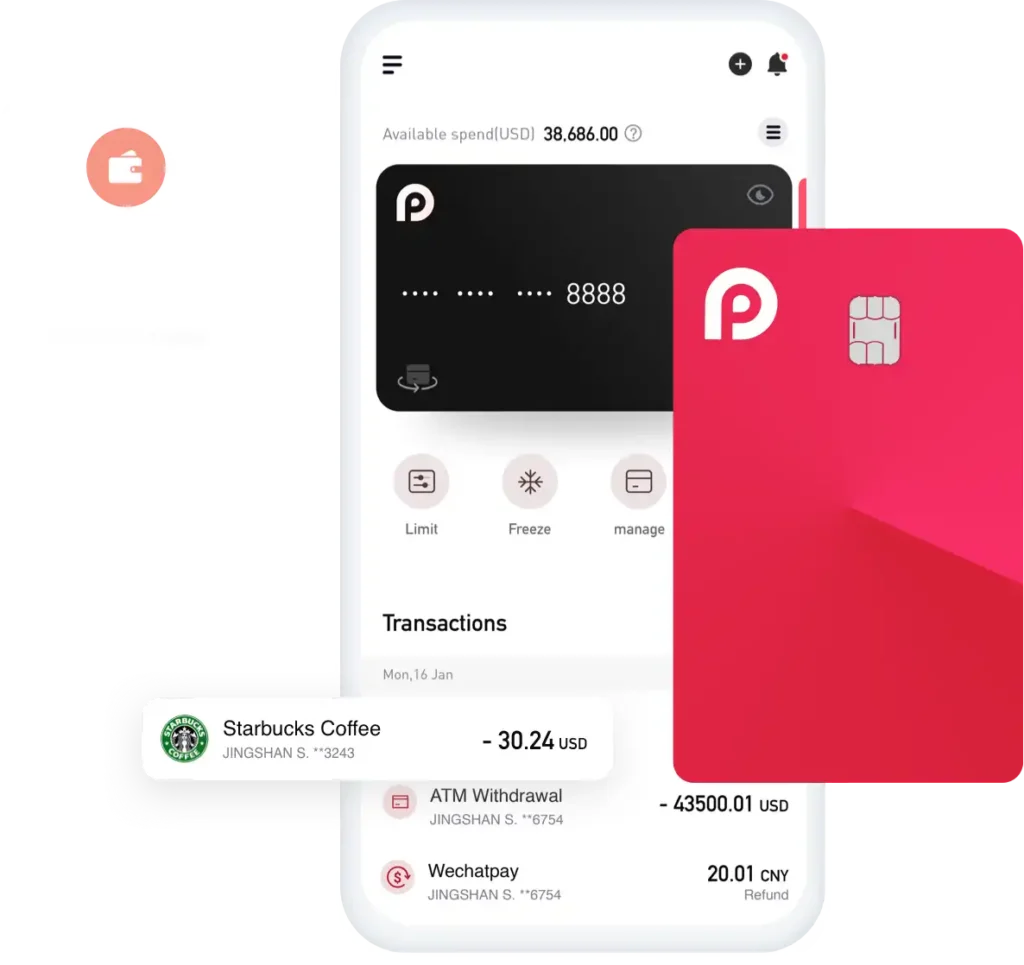

All-in-one payments hub

A single app that connects card payments, mobile wallets, payouts, and DApp integrations, with an eye toward letting users link on-chain wallets directly to a RedotPay Card.

Card features at a glance

- Use at global merchants and withdraw fiat at ATMs that support the network.

- Tap, swipe, or chip for in-person transactions; pay online like a standard card.

- DApp connectivity (roadmap) to let users bring their Web3 balance into the card flow.

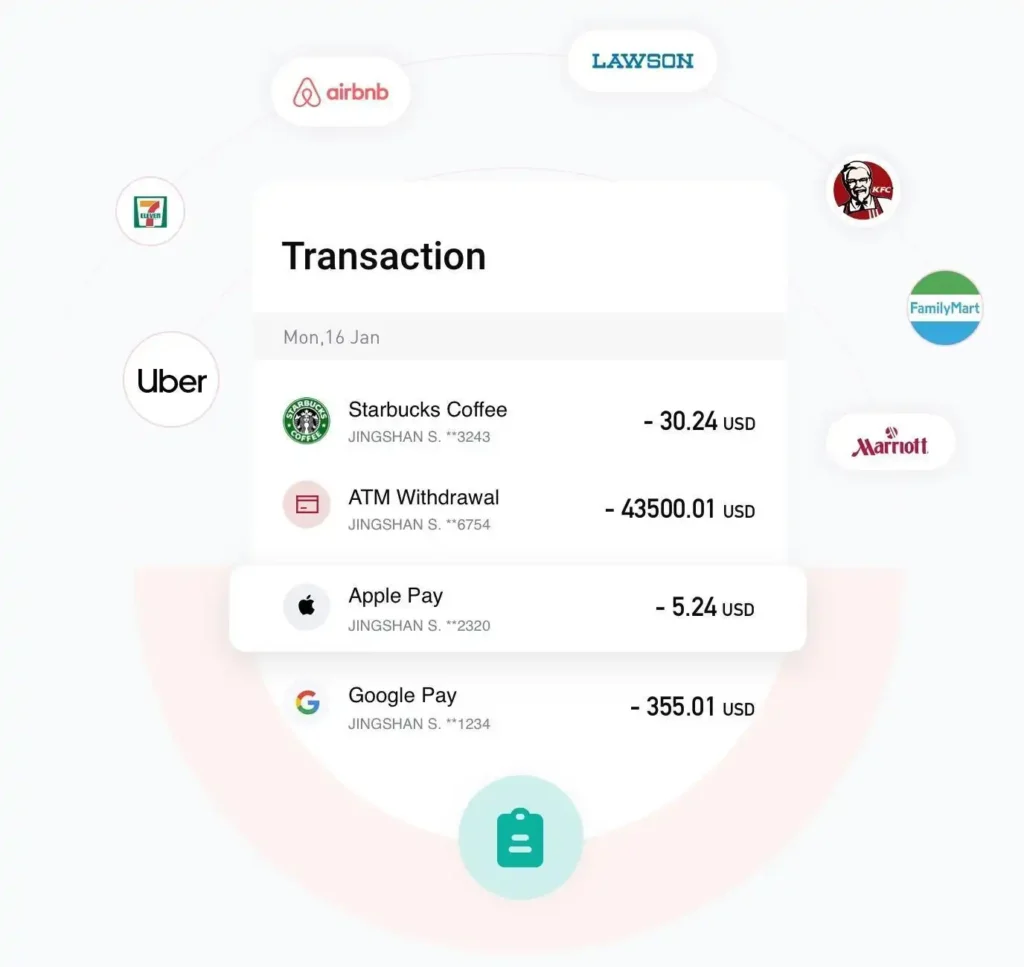

Wallet compatibility

Support for major payment services (e.g., Google Pay, PayPal, Alipay) helps extend card usage to contactless and in-app environments.

Partnerships & ecosystem moves

- Binance Pay integration: Announced in Dec 2023, enabling direct deposits from Binance Pay into RedotPay cards via a mini-program inside the Binance app—streamlining top-ups for everyday spend.

- Growth financing: Following an initial seed round in 2023, RedotPay indicated plans for a Series A raise with a global adviser, targeting additional capital to scale product and market coverage.

Security, custody & compliance

RedotPay’s public materials emphasize a compliance-first stack:

- KYC/KYT controls to help deter illicit activity and protect merchants and users.

- Asset custody with a licensed Hong Kong Trust Company, paired with insurance coverage from a specialist provider.

- HSM-based key management aligned to FIPS 140-2 Level 3 standards for private-key protection.

Availability, features, and limits can vary by country and verification tier. Always review official terms in-app.

What it means for everyday users

- Familiar checkout: Use a card where you already shop—online, in-store, or while traveling.

- Cash access when needed: Withdraw local currency at compatible ATMs (fees/limits may apply).

- Fewer steps: Reduce the friction of pre-converting crypto before purchases.

- Mobile-first: Tap-to-pay and wallet integrations for faster lines at the register.

Quick FAQ

Can I spend directly from my crypto balance?

That’s the goal: streamline payments so users can pay with crypto without extra conversion steps.

Do I need a specific exchange?

RedotPay has highlighted exchange and wallet integrations (e.g., Binance Pay) to simplify top-ups; check the app for current options.

Is it secure?

The company points to KYC/KYT, trusted custody, insurance arrangements, and HSM security as core safeguards.

Key takeaways

- RedotPay is positioning the RedotPay Card as a bridge from crypto to everyday spend—global merchants, ATMs, and contactless.

- Integrations (like Binance Pay) aim to make funding the card fast and familiar.

- Compliance, custody, and hardware-backed key security are central to the platform’s approach.