Lightning Payments UX Guide

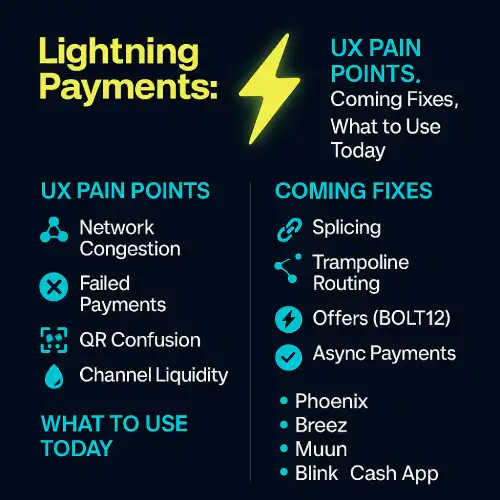

Lightning Payments: UX Pain Points, Coming Fixes, and What to Use Today

The Lightning Network keeps getting faster and cheaper, but user experience (UX) still trips people up—especially for non-custodial wallets. As new upgrades roll out, features like channel splicing, better Lightning Service Providers (LSPs), more automation, and stronger privacy defaults can make Lightning feel as simple as swiping a card. Until then, user-friendly bridges (like RedotPay) help everyday spenders avoid technical hurdles.

Where Lightning Payments UX Stands Today

Despite huge progress, most activity still flows through custodial apps because they’re easier. Non-custodial users face three kinds of friction:

1) Operational demands

- Staying online to receive payments

- Sharing invoices out-of-band (chat, email, QR)

- Locking BTC into channels and managing liquidity

2) Technical knowledge

- Node setup and constant connectivity

- Rebalancing across channels

- Troubleshooting stuck routes (often CLI)

- Secure backups for seeds and channel states

3) Current limitations

- Few standardized P2P UX patterns

- Always-online key use can raise risk

- Opening/closing channels incurs on-chain fees

- Privacy is improving, but not seamless yet

What’s Changing Next

Channel splicing → “Invisible channels”

Splicing lets wallets add/remove channel funds without closing them. Result: a single, unified balance where users don’t worry about on-chain vs. off-chain.

LSPs → Lower barriers, smarter defaults

Lightning Service Providers can pre-fund routes, handle uptime, and simplify rebalancing—so users keep control of funds with far fewer knobs to turn.

Automation → Less “always online”

Background services (often via LSPs) can receive on your behalf, prep liquidity, and reduce manual steps.

Privacy → Stronger by default

Taproot-aligned techniques (e.g., signature aggregation) can make Lightning transactions look like standard Bitcoin activity, improving plausible deniability with minimal UX tax.

What to Use Right Now

Many people just want simple daily payments. That’s where RedotPay helps today: pay at merchants, go contactless, and access ATMs (where supported) without managing channels or liquidity. It’s a practical bridge for crypto-to-everyday spend while Lightning UX continues to mature.

Availability, fees, and features depend on region and verification tier. Always check in-app terms.

Practical Guidance

- Casual users: Try a custodial or LSP-backed wallet for minimal setup.

- Power users: Choose wallets that support (or plan) splicing and automations.

- Privacy-minded: Prefer Taproot paths where offered; avoid reusing invoices.

- Merchants: Integrate with LSPs to reduce failed payments and support offline receiving.

Key Takeaways

- Lightning’s speed is great; UX is the next frontier.

- Splicing, LSPs, automation, privacy are the big levers to watch.

- If you need plug-and-play spending now, a hybrid approach (e.g., RedotPay) is often easiest.

FAQ

Why is non-custodial Lightning still hard?

Liquidity, uptime, backups, and routing policy are non-trivial. New tooling aims to hide most of that.

Will splicing remove channel headaches?

Not entirely, but it should significantly reduce reopen fees and balance juggling.

Can I receive payments while offline?

Not natively without help, but LSPs and automations are making this increasingly feasible.

Is Lightning private?

Better than many card rails, but not perfect. Taproot and aggregation help move privacy toward “on by default.”