Crypto Cards Explained

The Future of Spending: What Are Crypto Cards & How Do They Work?

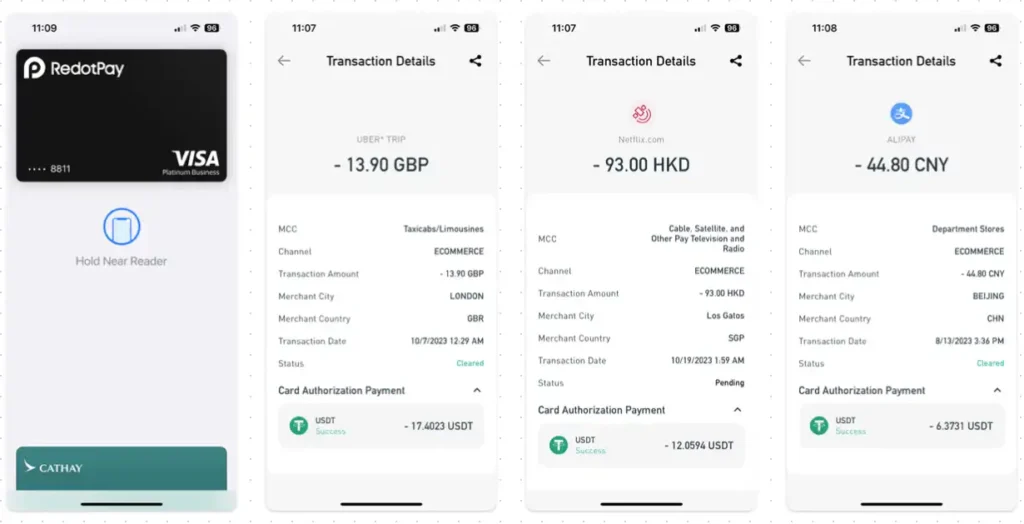

Crypto cards let you pay at regular merchants with your digital assets. At checkout, your crypto is auto-converted to local currency—so you spend like a normal card, without manual swaps.

What Is a Crypto Card?

A crypto card is a debit, prepaid, or credit card connected to a wallet/balance of digital assets. You use it online, in-store, or at ATMs where the network is accepted. The provider converts crypto → fiat in real time to settle the transaction.

How Crypto Cards Work

- Fund your account (BTC, ETH, stablecoins, etc.).

- Tap/swipe/checkout like any card.

- The provider auto-converts just enough crypto to cover the charge (plus fees).

- Your app tracks balances, conversions, and receipts in one place.

Why Use a Crypto Card?

- Everywhere acceptance: Spend where the card network is supported.

- No manual conversion: Real-time crypto→fiat at the point of sale.

- Lower friction abroad: Useful for cross-border spend (check FX/ATM fees).

- Fast settlement experience: Transactions confirm like a standard card.

- Rewards & controls: Some programs offer perks, limits, freeze/unfreeze, alerts.

- Security: 2FA, biometrics, card lock, and HSM-backed key custody (provider-dependent).

Things to Watch

- Fees: Network, conversion, FX, ATM, and program fees vary.

- Networks: Always match deposit networks (e.g., ERC20 vs TRC20).

- Limits & regions: Availability differs by country and verification tier (KYC).

- Taxes/records: Conversions may have tax implications—keep statements.

Why Choose the RedotPay Card

Availability, features, and limits depend on your region and verification status. Always review the latest terms in-app.

- Global reach: Use in 150+ countries where the network is accepted.

- Credit + Debit options: Choose your preferred way to pay.

- Instant conversion: Seamless crypto→fiat at checkout.

- High daily spend capacity: Up to $500,000/day for qualified users.

- Multi-asset support: BTC, ETH, and major stablecoins.

- Affiliate tiers: Earn more with tiered commissions as you refer.

- Security: Encryption, real-time fraud monitoring, licensed custodians, and HSM key protection.

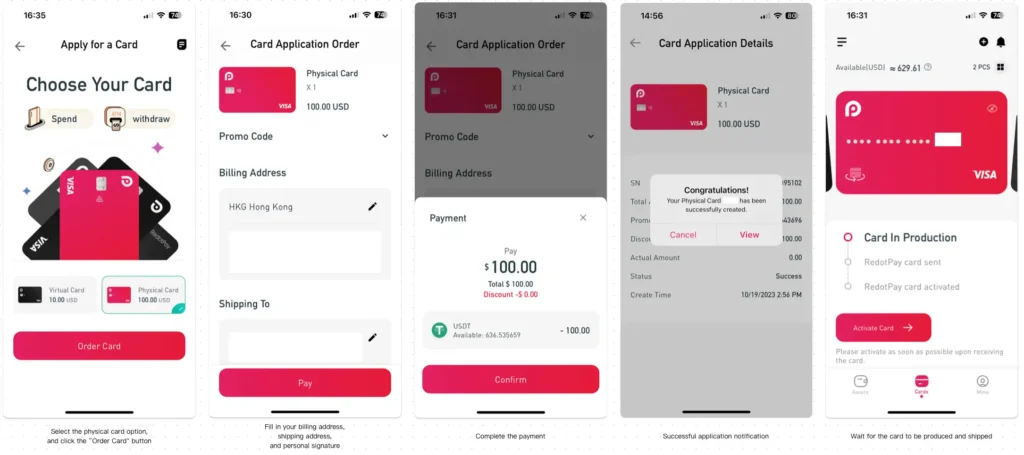

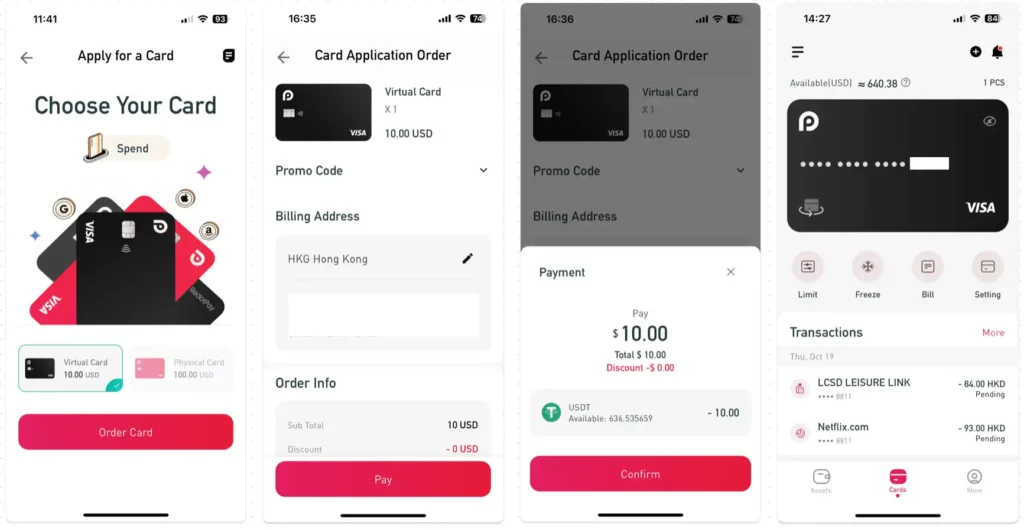

Get started: Apply in minutes, complete KYC, fund with crypto, and add your virtual card to mobile wallets. Order a physical card for tap/chip/ATMs.

How to Get a Crypto Card (Step-by-Step)

- Pick a provider (fees, regions, assets, rewards, support).

- Sign up & KYC (standard AML compliance).

- Fund your account (check networks/fees).

- Activate virtual/physical card (add to Apple/Google Pay where supported).

- Spend & track in the app; set alerts/limits for control.

FAQs

Do I spend crypto directly?

The provider auto-converts your crypto to local currency at checkout.

Can I use it everywhere?

Anywhere the card network is accepted—subject to regional rules and MCC restrictions.

What about fees?

You may see network, conversion, FX, ATM, and program fees. Check the Fees & Limits page.

Is it secure?

Providers (like RedotPay) use KYC/KYT, licensed custody, HSM key security, fraud monitoring, and app-level controls.

Ready to spend crypto like cash? Apply for the RedotPay Card—fund, tap, and go.