AML Screening at RedotPay

The Crucial Role of AML Screening in RedotPay: Why You Can’t Afford to Ignore It

Anti-Money Laundering (AML) screening is a non-negotiable part of onboarding at modern fintechs like RedotPay. It verifies who’s joining, flags high-risk profiles early, and helps keep the platform—and its users—safe from fraud, sanctions breaches, and illicit finance.

What AML Screening Means

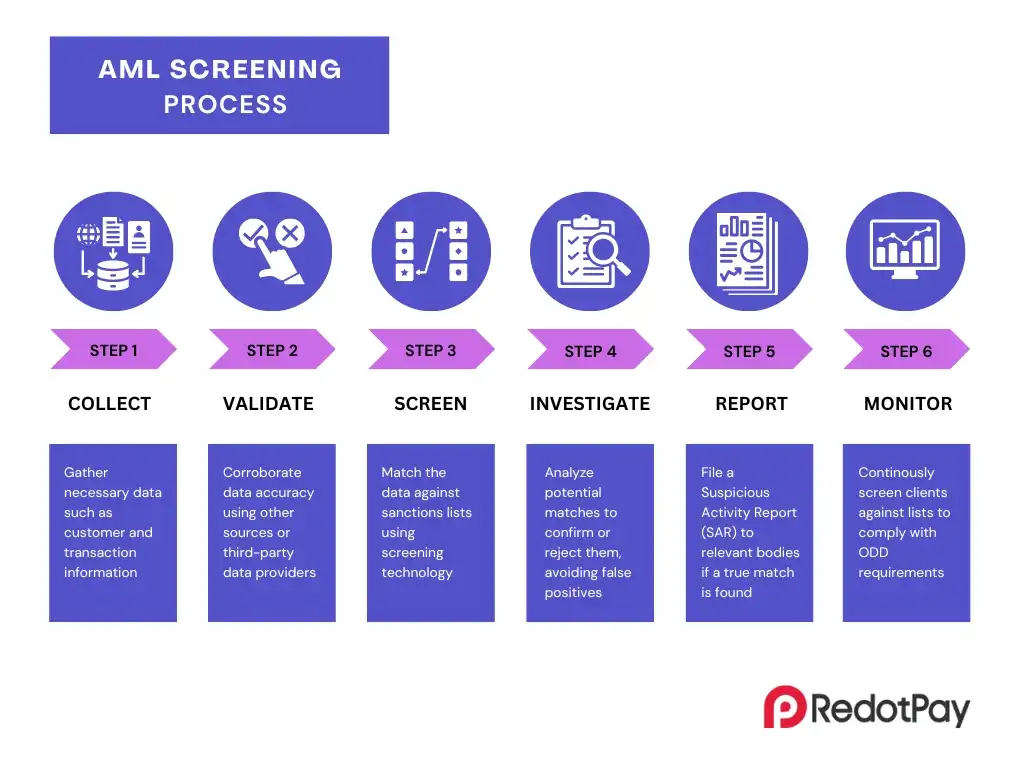

AML screening is a set of checks run during customer onboarding (and periodically afterward) to spot potential money-laundering or terrorist-financing risks before they enter the ecosystem. It complements KYC/identity verification and gives compliance teams the signals they need to approve, review, or decline accounts.

The Core Checks You Should Expect

- Customer Identification (KYC):

Confirming legal name, date of birth, and a government-issued ID; often with biometric/selfie match. - Sanctions & Watchlists:

Screening names against domestic and international lists to avoid prohibited relationships. - PEP & RCA Screening:

Detecting Politically Exposed Persons and Relatives/Close Associates who may warrant extra review. - Adverse Media:

Searching credible news sources for allegations of fraud, corruption, or financial crime. - Enhanced Due Diligence (EDD):

Deeper checks for higher-risk cases (e.g., high-risk jurisdictions, complex ownership, unusual activity).

Outcome: A risk score and documented decision trail—approve, request more info, or reject.

Why AML Screening Matters for RedotPay

- Regulatory compliance: Avoids fines, enforcement actions, and corridor shutdowns that disrupt users.

- Fraud reduction: Stops account takeovers, mule accounts, and synthetic IDs at the door.

- Platform integrity: Keeps payment rails open and card acceptance healthy by protecting merchant relationships.

- User protection: Reduces the chance that legitimate customers are caught up in suspicious activity or de-risking later.

How RedotPay Approaches AML

- Risk-based onboarding: Verification depth scales with user profile, region, and intended product use (e.g., card, payouts).

- Ongoing monitoring: Periodic list refreshes and transaction-pattern reviews (KYT) to catch risks post-onboarding.

- Clear escalation paths: When red flags appear, cases move to manual review with documented outcomes.

- Data minimization & security: Collect what’s necessary, protect it, and retain it per applicable regulations.

(Availability of features and verification tiers may vary by jurisdiction. Always check in-app notices and official terms.)

What Applicants Can Do to Pass Faster

- Use a valid, unexpired ID and take photos in good light.

- Match details exactly (name, address) to your documents.

- Explain your use case if asked (e.g., card spending, payouts).

- Respond quickly to requests for additional documents (proof of address, source-of-funds).

FAQs

Is AML screening mandatory?

Yes. It’s a legal and operational requirement for most financial products.

Will AML screening delay my account?

Most users pass quickly. Higher-risk cases or unclear images can add time.

What happens if I’m flagged as a PEP?

PEP status isn’t an automatic denial, but it can trigger EDD and tighter limits.

Is my data safe?

Reputable providers follow strict security and retention controls. Review the official Privacy Policy for specifics.

Key Takeaways

- AML screening protects users, merchants, and payment corridors.

- Expect KYC + sanctions/PEP/adverse media at onboarding, with EDD where needed.

- Completing checks thoroughly now prevents account friction later.